Understanding your employer’s tax obligations will help you protect your business. You need to be familiar with and pay attention to many types of taxes, such as the state unemployment tax, the federal unemployment tax, and withholding from your employees’ paychecks.

Classification of Workers

Whether your business is a nonprofit or a for-profit entity, you must classify workers to fulfill employer tax obligations. Incorrectly classifying workers can result in penalties, back taxes, and legal issues.

The IRS has provided an overview of the rules for classifying workers. However, there are differences between the rules used by the IRS and those used by the federal DOL. Using a tax professional can help you ensure accurate statements.

The IRS has provided 20 common law factors for determining the worker’s status. These factors include whether the employer can direct the worker’s work and whether the employer financially or behaviorally controls the worker. Other rules apply to statutory employees and non-statutory employees.

The IRS has issued a policy statement defining what constitutes an independent contractor and an employee. Independent contractors are defined as people who are customarily engaged in an independently established trade or profession. Using a company’s equipment or facilities makes you more likely to classify a worker as an employee.

There are also common law rules that distinguish between employees and independent contractors. The main distinguishing characteristic is whether the worker is independent or not.

Withholding from Employees’ Paychecks

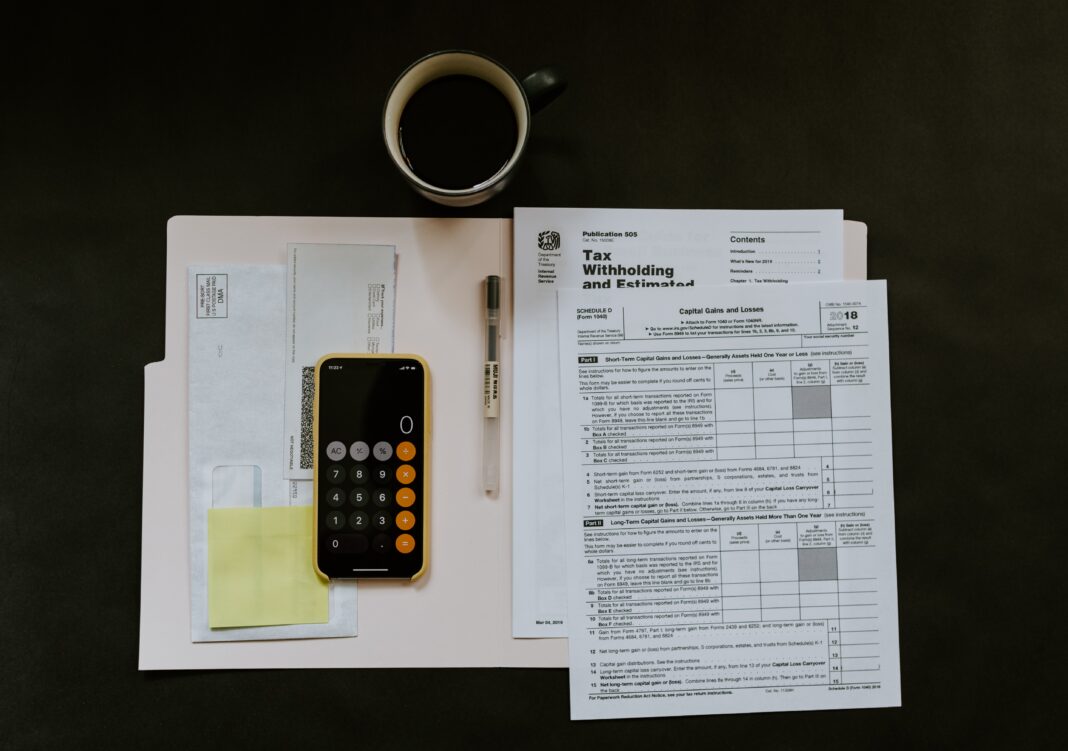

Whether running a small business or owning a large company, you must understand how to withhold payroll taxes. In the United States, wage earners must pay federal and state taxes. Aside from federal taxes, some states also collect income tax. The tax each employee pays depends on how much they earn and what personal elections they make.

Payroll taxes are calculated and paid according to the employer’s state and federal withholding requirements. Employers are required to withhold federal income tax and social security taxes. They are also responsible for withholding Medicare and FUTA taxes.

The tax withholding calculator the IRS provides can help determine how much your employees will owe.

If your company is not compliant with tax laws, the IRS may visit your business to investigate. Failure to pay payroll taxes can result in huge fines or time behind bars. However, payments may be relaxed if your business is in a federally declared disaster area.

Filing and Remitting Payroll Taxes

Keeping up with payroll taxes can be daunting. To make matters worse, there are many confusing acronyms and abbreviations to contend with. In addition, it’s important to note that not all payroll taxes are created equal. Some employees are exempt from paying taxes, and some employers are obligated to withhold other amounts from their employees’ paychecks.

While there are no guarantees, taking a proactive approach to the payroll process can help your business grow. This may involve using an outside payroll provider or outsourcing the tax calculations to an IRS-approved service. You can also check with your state’s Department of Revenue to learn about the laws and regulations governing payroll taxes.

A good place to start is with a review of your employee roster. You’ll want to ensure that your employees are on board with the various tax obligations you have tasked them with. In addition to payroll taxes, your employees may be subject to federal or state taxes, such as unemployment or federal income tax. If your employees are subject to federal taxes, you must ensure they receive a federal tax ID number.

State Unemployment Tax

Depending on your state, you may have to pay state unemployment taxes if you have at least one employee on any day of the week for twenty weeks or more during a calendar year. Again, depending on the state, the amount you have to pay depends on several factors. You can find information on how to pay state unemployment taxes online. Alternatively, you can contact the state unemployment tax office for more details.

Your pay depends on your state’s wage base and tax rate. Typically, you will pay these taxes every quarter. However, some states may exempt you from paying them. Some states may also require additional withholdings from your employees’ wages.

You must pay state unemployment taxes if you are a general business employer with a taxable wage base of at least $1,500 in any calendar quarter. Depending on your state, you may also be subject to a SUTA tax. Your employer and funds state unemployment insurance programs pay this tax. Some states will exempt businesses with fewer than four employees from paying SUTA.

If you are a church that does not pay unemployment taxes, you may be required to notify your employees. In addition, some states may also require you to file a wage report every quarter. These reports detail the wages you pay to your employees. You can file the report online or through interaction. The corresponding tax forms can also be downloaded from your state’s website.

If you are an employer with a taxable wage base of less than $7000, you can claim a tax credit. The tax credit equals 5.4 percent of the federally taxable wages you pay. This credit is only applicable for the first $7,000 you pay in wages annually.